Estate planning is an essential process, where you will be legally documenting your assets and property sharing decisions. Your 'Will' will be legally performed by your attorney after your death. Property planning can also be an important step to protect your financial future too, as almost all businesses have abandoned the pension and retirement plans.

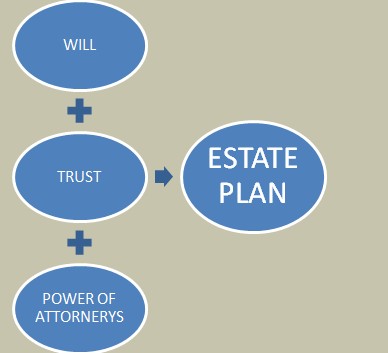

The estate planning can be of any kind, such as a will trust, power of attorney, the power of appointment, property ownership and etc. At some point of time, it becomes necessary to decide what your descendants should receive from you, after your death. It helps you resolve your concerns regarding your assets, and it gives you with the peace of mind in the golden period of your life, after the retirement.

Tips for estate planning

There are various aspects and key elements of planning your estate, which can help you to reduce the worries and maximize the estate benefits to the heirs. To know more about estate planning, you can also look for http://speedwelllaw.com/alexandria-estate-planning-attorney/.

Specific Declarations – Probably it is the most important aspect of estate planning. The failure in planning may give rise to legal problems, and your actual receiver may not be able to get the estate. The information of property sharing should be clear and specific.

Deciding the Plan for Spending – If you want that your assets to be used for any other goodwill, like making of trusts like colleges, then the allocated lawyer is legally bound to make these plans. It means that they must spend the amount defined by the trust.

Estate Planning Team – Your lack of knowledge on this subject may cause problems to your heirs. So, it is advised for you to work on it with a team of experts. The financial advisor will help you design suitable investment plans. You can also click to read more about estate planning.

Minimizing Estate Taxes and Other Income tax – While selecting a financial advisor firm, make sure that they simply understand your planning needs. They should also have tax experts in their team, to advise you on the possibilities of reducing the payable tax amount by your heirs.